97,000 real estate enterprises’ transformation "the second half" financial model transformation to reduce debt into a starting point.

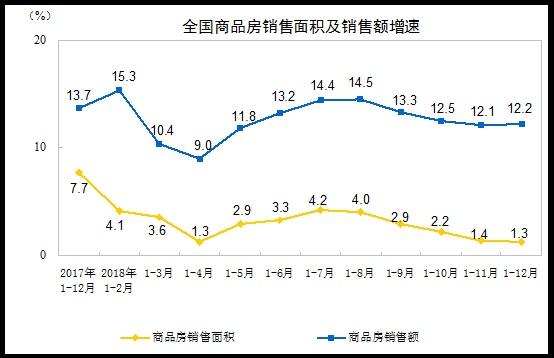

Huang Qifan believes that the huge annual real estate transaction volume of 16 trillion to 17 trillion will surely become a historical turning point, and the future market will gradually shrink.

About 97,000 real estate enterprises are gradually entering the deep-water period of transformation. With the implementation of measures such as deleveraging and stabilizing finance, China’s real estate sector will enter the "second half" era of stock management.

"Overall, the era of China’s real estate in short supply is over." Huang Qifan, vice chairman of China International Economic Exchange Center, said at the World Chinese Real Estate Society held on July 13th, "The huge annual transaction volume of real estate in China is bound to become a historical turning point, and the market will gradually shrink in the future; Therefore, in the next decade, I predict that the real estate growth rate will not be higher than China’s GDP and M2 growth rate, but it will not fall too fast and will enter a stage of steady growth in an all-round way. "

How should real estate enterprises with an average debt of more than 80% go into battle lightly? "Learning from the experience of developed countries, in fact, financial transformation is also crucial for housing enterprises." Wang He, secretary-general of the World Chinese Real Estate Society, said, "The transformation of real estate enterprises should start from the financial field, such as REITs (real estate trust and investment funds) to reduce the burden on enterprises."

At present, nearly 100,000 real estate enterprises registered in industrial and commercial registration have become the epitome of China’s real estate development in the first half.

According to Gao Bo, director of the Center for Urban and Real Estate Research of Nanjing University, the development of real estate has contributed to GDP, promoted the process of urbanization, promoted land finance and housing finance, and reduced financial risks. Only by taking the modernization of the housing system as a prerequisite can the real estate industry really do it.

For example, in 2018, the added value of the real estate industry in the United States accounted for about 13.2% of GDP. In the first three quarters of the same year, the added value of real estate in China was about 4.36 trillion, accounting for 6.69% of GDP.

There is no doubt about this step of transformation. How to turn? Many experts in the research field believe that on the one hand, it is necessary to shift from extensive expansion strategy to refined operation, on the other hand, enterprises need to fundamentally change their financial model.

"The transformation of real estate enterprises should pay attention to ‘ Lianggao ’ That is, high quality and high technology. " Jia Shenghua, director of the Real Estate Research Center of Zhejiang University, said, "High quality means that housing enterprises should return to their final purpose of residence, not quantitative expansion; High technology means that more technical means need to be integrated into the development and management of houses. "

"REITs are like an IPO of an office building, and the share can be transferred, traded and distributed." Hu Feng, a senior director of dtz and head of the North China District Valuation and Consulting Service Department, told the First Financial Reporter, "It is equivalent to sharing this building. If you buy a share, you can enjoy the benefits of the share. This share can be transferred and transferred, so the assets will flow."

According to the First Financial Reporter, Ping An Real Estate, Poly Real Estate, Xuhui and Longhu have also stepped in since CITIC, the first private equity REITs in China, was launched in May 2014. According to the data of Industrial Securities, as of May 12 this year, 48 REITs have been issued in China, with a total amount of 93.42 billion yuan.

The REITs research group of Guanghua School of Management, Peking University estimates that the market size of REITs in China is about 4 trillion to 12 trillion.

Liu Qiao, dean of Guanghua School of Management, Peking University and professor of finance, believes that REITs will probably become one of the most important starting points for China’s financial system reform or supply-side reform in the next few years.

Liu Qiao also wrote in CBN that REITs are not limited to real estate. At present, the problem of financing difficulty and high cost for enterprises in China, especially private enterprises, has been very prominent. The introduction of REITs is conducive to reducing systemic financial risks and promoting the development of real estate industry and upstream and downstream industries.

"If the capital operation in previous years was to borrow money to get land, then in the second half of the stock management era, we must calm down and operate our assets well." Chen Xiaoou, independent director of Yuexiu Real Estate Trust, told the reporter, "We are providing asset management services for Chengdu Luhu Eco-city, such as business format and asset sorting, and later asset securitization."

In the era of stock management, in addition to residential real estate, building economy will also become an important carrier to adjust industrial structure.

According to Zhu Jianhui, head of the research department of Jones Lang LaSalle in West China, "At present, the building economy is also operating under the dual-track background of urbanization and urban renewal; We also found two characteristics: first, the demand side of building transformation mostly comes from technology-driven enterprises such as we work and incubation centers; Second, real estate buildings such as Joy City began to build amusement parks, maternal and child rooms, etc., paying more attention to the humanistic value brought to consumers. "

The quality transformation of housing enterprises under the empowerment of many technologies has gradually landed nationwide. In other words, housing enterprises really began to bid farewell to the extensive and expansive development model in the past, focusing on social services that are people-oriented and meet domestic demand.

How does technology drive the development of cities and real estate? According to Wang Yeqiang, director of the Land Economy and Real Estate Research Office of the Institute of Urban Development and Environment of China Academy of Social Sciences, on the one hand, smart cities should be built through technologies such as the Internet of Things, cloud computing and big data to meet the needs of residents’ production and life; On the one hand, infrastructure and industrial informatization should be highly developed.

Some large real estate enterprises are integrating big data and Internet of Things into residential management and services.

Wu Zhihua, CEO of Greentown Service Group, said, "Take a certain community as an example, the proportion of elderly people over 60 years old is 10.98%, and the proportion of second children in the community is higher than the national average; Through this kind of analysis, we have laid out the services of children’s education, nutrition and rehabilitation for the elderly in the community. At present, 130,000 people have established health records on our platform, and 400,000 elderly users are enjoying paid chronic disease management services.

Small and medium-sized housing enterprises choose to cut in from low energy consumption and green ecological technology. "The core of real estate is still the residential industry, and this cannot be lost. The reason is that it can develop rapidly and standardize, and because it has a large market consumer group and belongs to popular products, it has strong anti-risk ability. " Li Biao, chairman of yueda Real Estate Group Co., Ltd. said, "In addition to paying attention to building quality, scientific research and development is also our strength."

Previously, Jinmaofu attracted much attention in the industry because it proposed 12 black technologies (to meet residents’ comprehensive household needs such as air, temperature, humidity and noise), and the average price of its housing in Hongkou, Shanghai New Town was about 102,000/square meter.

"We already have the 12 major scientific and technological systems of Jinmaofu, and we have a clear understanding of ourselves, that is, to be an expert in quality life operation." Li Biao told the First Financial Reporter, "In addition to residential technology research and development, looking further, we are developing projects around the Yangtze River Delta urban agglomerations (such as Suzhou, Nantong and Yancheng)."

Some real estate big data companies have already quietly laid out. "According to more than 50 major industries involved in real estate, we divided the data into eight thematic directions, including transaction end, residential security end and residential service end." Yan Zhimin, chairman of Hangzhou Zhongfang Information Technology Co., Ltd. told the First Financial Reporter.

"For example, in Fuyang, which is more than 20 kilometers away from Hangzhou, the price of a parking space in a certain community reached 800,000, but the house price in the community was around 10,000. At that time, the people and the media were very controversial; Therefore, we assisted the government to make a data analysis and look at the reasonable reasons according to the floor price and market environment. In the future, data-based disaster reduction, shock absorption, escape, etc. will be used to ensure residential safety. " Yan Zhimin added.