How much pension can I get when I retire? Go to this platform and do the math yourself.

How much pension can I get in the future? This is a problem that every pension insurance participant is concerned about. For a long time, people only know how much money they have paid, but rarely can they figure out how much money they will get in the future and whether the endowment insurance they have paid is worth it. Recently, the national social insurance public service platform was officially launched, and the insured can finally calculate how much pension they can receive in the future!

Want to calculate your own pension? Difficult!

How much does the employee pension insurance have to pay every month? The easiest way is to look at the deduction amount of endowment insurance on your salary slip, which is clear at a glance.

Old-age insurance is divided into two types: residents’ old-age insurance and employees’ old-age insurance. At present, employees’ old-age insurance is more concerned. In fact, there is a clear calculation method for pension benefits, but this calculation method is extremely complicated. For example, the pension insurance benefits for employees in Beijing are as follows:

After July 1, 1998, the basic pension consists of basic pension and personal account pension, and before June 30, 1998, the basic pension consists of basic pension, personal account pension and transitional pension.

Worked before June 30, 1998, pension composition:

Basic pension

Based on the average of the average monthly salary of employees in this city in the last year when the insured retires and the average monthly payment salary of himself, 1% will be paid for each full year according to the insured’s full payment period.

Transitional pension

The sum of the monthly transitional pension calculated according to the deemed payment period and the monthly transitional pension calculated according to the actual payment period.

Personal account pension

The accumulated storage amount of the insured’s personal account is divided by the number of months specified by the state. Different retirement ages correspond to different months. The Monthly Table of Personal Account Pension of Basic Old-age Insurance for Employees in Urban Enterprises can be easily found on the Internet.

The sum of the above three parts is the amount of pension that retirees can receive.

If you calculate according to the formula, it can be said that it is very frustrating. As a result, many people are trying to search for a "one-click generation" calculator on the Internet to calculate how much pension they can receive in the future.

However, although the calculation formula is ready-made, the amount of pension is closely related to the insured’s salary, average social salary, interest rate and other factors. These factors are variables, and it is impossible to accurately calculate the amount of pension under unpredictable circumstances.

Therefore, most of what can be searched online is only calculators for the amount of payment, and it is difficult to find calculators that can predict pension benefits.

give an example

The estimated benefits far outweigh the payment.

Suppose Wang, female, is currently 35 years old and has accumulated payment years of 11 years. Her "deemed payment period" is 0. Wang’s salary level fluctuates at twice the social average salary. For the convenience of calculation, let’s assume that her "previous annual average contribution wage index" is 2; Her "personal account deposit at the end of last year" was 107,519 yuan. The "average monthly salary of employees on the job last year" in Beijing, where she participated in the insurance, was 7855 yuan (the average salary of employees in full-caliber urban units in 2018). The assumption of "the average wage growth rate of employees in the future" is 8%, and the "future personal account bookkeeping rate" is also assumed to be 8%. "This year’s payment salary" is 20,761 yuan, and the future payment salary growth rate is also assumed to be 8%.

Through the calculator, the result shows that Wang will retire in 2039, and his basic pension is about 32,885 yuan, including 19,379 yuan for basic pension, 13,506 yuan for personal account pension and 0 yuan for transitional pension. In this way, Wang’s future pension is expected to exceed 30,000 yuan. Compared with the old-age insurance premiums paid before, the benefits are definitely far greater than the pay.

Many people will be surprised: "Can you get a pension of more than 30,000 yuan in the future? Will it be that high? " It should be noted that the simulation calculation here is the pension level after 20 years, and the future income situation cannot be felt by the current level of economic development. Just like 20 years ago, people’s wages were generally only a few hundred yuan, but now they have reached several thousand yuan. It is a truth that the original income can no longer be measured by the current economic level.

In addition, it should be emphasized that the calculation formula of pension involves many variables, which are only calculated under the simulation hypothesis of many variables and cannot truly reflect the future pension level of the insured. The actual amount shall be calculated by the local social security agency at the time of retirement.

operate

The official platform predicts that pensions will be divided into ten steps.

At present, the national social insurance public service platform can provide services such as social security annual enrollment information inquiry, treatment qualification authentication, pension calculation, social security relationship transfer inquiry, medical treatment inquiry in different places, overseas exemption application, social security card and electronic social security card status inquiry. Among these functions, pension calculation is very eye-catching. Although the platform provides a calculator, many people are still confused about the information that needs to be filled in.

The reporter logged into the platform and experienced it.

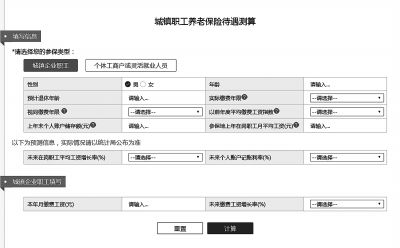

Click to enter the page of calculating the pension insurance benefits for urban workers. First, you must choose the type of insurance. This option includes "employees of urban enterprises" and "individual industrial and commercial households or flexible employees". Because most of the insured persons are insured through enterprises, here is an example of "employees of urban enterprises".

1 Fill in basic information such as gender and age. In the "estimated retirement age", the average male is 60 years old, the female cadre is 55 years old and the female worker is 50 years old.

2 determine the payment period. The column of "actual payment years" refers to the accumulated years of actual payment of social security. You can check your own payment information over the years, which is clearly recorded. The "deemed payment period" is very special. "The deemed payment period" refers to the continuous working time calculated according to the state regulations before the actual payment period of all the working years of employees. To put it bluntly, although you haven’t worked or paid the old-age insurance for some years, the old-age insurance will be considered as paid, and these years will be counted in your payment period to give you a pension.

According to the time when individual accounts of endowment insurance are established in different places, the starting time of deemed payment period is also different. Most of them were in the early 1990s, and those who worked before that had deemed payment period. Nowadays, young and middle-aged workers generally don’t involve the deemed payment period. Just fill in zero for this option.

3 determine the payment wage index. The "previous annual average payment wage index" is the most troublesome. The annual average payment wage index refers to the average payment wage index of social co-ordinators participating in endowment insurance over the years. It is based on the payment declared by the insured every year, and the salary is divided by the average salary of the local employees in the previous year, and the payment wage index of the year of payment is obtained. This is calculated once a year, and the annual payment wage index is added, and then divided by the actual payment period. Simply understood, the payment wage index means that the salary of the insured is several times that of the social security. Average the multiple of each year, and it is the annual average payment wage index.

4. Inquire about the amount of personal account storage at the end of last year. "The amount of personal account storage at the end of last year" is the sum of the personal account part and interest of the previous pension insurance, and most people will not remember how much money there is. You can check your own social security payment information over the years, which is clearly recorded (you can log on to the international social insurance public service platform or the Beijing social insurance online service platform).

5. Determine the average monthly salary of employees on the insured ground in the previous year. The "average monthly salary of employees on the insured ground in the previous year" will be announced by the social security department every year, and you can search and query it.

6. Forecast the future increase of social wage. "The average wage growth rate of employees in the future" is to fill in an estimated future growth rate of social wages, which is difficult to estimate. Looking up the average wage growth rate of employees released by Beijing Municipal Bureau of Statistics in recent years, we can find that this figure varies from high to low, reaching nearly 18% at high and just over 4% at low. So you can choose according to your personal prediction.

7 estimate the future personal account bookkeeping interest rate. The bookkeeping interest rate of personal account refers to the interest generated by the accumulated storage amount of personal account of endowment insurance. This bookkeeping interest rate should be determined with reference to the local average wage growth rate of employees in the previous year, the bank’s resident time deposit interest rate, the actual income from the operation of the endowment insurance fund and other factors. For example, the bookkeeping interest rate in 2016 was 8.31%, and the bookkeeping interest rate in 2017 was 7.12%.

8. Inquire about my payment salary this year. You can check your social security payment information.

9 forecast the growth rate of future payment wages. Insured personnel can estimate how much their annual salary will increase in the future.

10 calculation. After all the information is entered, click the "Calculate" button, and the system will give the pension budget result. Our reporter Dai Lili