Stock (1): What do you buy when you buy stocks?

Hello, my name is Peking University Xu Yuan, and welcome to my investment class.

Today we enter the second part of the course, the investment tools part. In this part, I will explain to you the basic nature of investment tools, including stocks, bonds, funds, real estate, gold and so on. For example, these are 18 kinds of weapons in the martial arts field. After understanding the basic properties of these weapons, we can choose the weapons that we can take advantage of.

As the saying goes, "If you want to do a good job, you must sharpen your tools first." Without understanding the nature of these tools, you are like a tiger without teeth, and you will be very passive in the arena of investment.

Today is the first lecture on investment tools. We begin to talk about one of the most common and important tools, namely stocks. Regarding stocks, we focus on six issues.

First, when we buy stocks, what are we buying? In particular, some companies are not profitable at all, let alone paying dividends. Why are they still worth so much money? How exactly is this priced?

Second, how to judge the stock price? Some stocks are very cheap, can you buy them? Some stocks have high unit prices, why do they go up all the way? How to judge?

Third, there are so many stocks in the market, how to quickly grasp the market situation?

Fourth, how is the stock price determined? What are the different factors?

Fifth, do A shares earn money? If you don’t make money, why are so many people playing in it?

Sixth, what kind of stocks have high returns?

Let’s look at the first question first. What do we buy when we buy stocks? In particular, some companies on the A-share market are not profitable, and there is no dividend. Why are they still so expensive? In order to clarify this problem, I divide stocks into two categories, dividend-paying and non-dividend-paying

Dividend-paying stocks have a relatively simple principle. We buy a stock because we are optimistic about the cash flow that this stock can bring.For example, if you spend 10 yuan on a stock and pay a dividend of 1 yuan a year, after ten years, you will return to your capital (for simplicity, discount is not considered here), and all dividends in the future will be profits.

If you divide it into 50 cents a year and pay it back in 20 years, all future dividends will be profits. At this time, you spent 10 yuan to buy it, which is all future dividends.

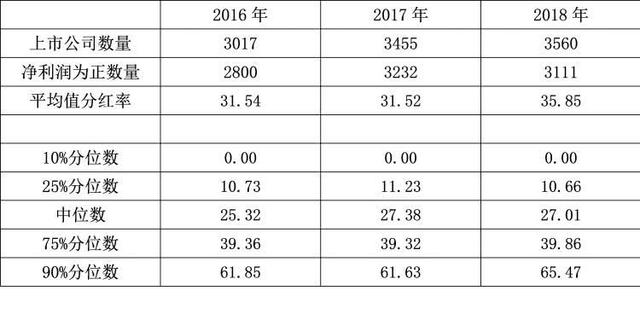

You may say, where is the company giving such a high dividend rate now? Actually, it’s not. You can have a look at Table 1. Table 1 shows the distribution of dividend rate of A-share listed companies from 2016 to 2018. As you can see, the average dividend rate of listed companies is over 30%, which is not low.

This is not the most exaggerated. The 10% companies with the most dividends have a dividend rate of over 60%. At present, there are more than 3,000 listed companies in A-shares, of which more than 300 have a dividend rate of over 60%. Therefore, the statement that A shares do not pay dividends is not consistent with the real data.

Table 1: Dividend rate of A-share listed companies (2016-2018,%)

Note: Before calculating the dividend rate, companies with negative net profit in this year are excluded, and the dividend rate is equal to the total annual dividend of the company divided by the annual net profit attributable to shareholders of the parent company.

As of the production date of this table (November 2019), the dividend data for 2019 has not been published, so the data from 2016 to 2018 are used. Source: Wind information.

In fact, what you need to pay attention to is not the companies that don’t pay dividends, but the dividend rate of some companies is too high, which is a bit abnormal. You need to see what is going on. In order to illustrate this situation, we have specially compiled Table 2 and listed the companies with the highest dividend rate in recent years.

When sorting out Table 2, we made a screening and only considered large and medium-sized companies with positive profits and large market value of more than 10 billion. The data of small and micro enterprises fluctuates greatly, so we will not consider it for the time being.

Table 2: Top 30 Dividend Rates of Companies with Market Value of Over 10 Billion (2016-2018,%)

Note: The data comes from Wind. Before calculating the dividend rate, the companies with negative net profit for the year and companies with a total market value of less than 10 billion at the end of the year were excluded.

If you look at Table 2, many companies have a high dividend rate, and some companies even have a dividend rate of more than 100%, that is, dividends exceed profits. Why is this happening? To sum up, there are probably three possible reasons.

In the first case, the company has little temporary profit, but in order to maintain the stability of dividends, it still maintains a consistent dividend level. In this case, even if there is a temporary shortage of cash, the operation is still stable, so paying more dividends is to show the market that everything is under control and there is no need to panic.

China Petroleum, for example, has done such a thing. Due to lower oil and gas prices, its net profit in 2016 dropped by nearly 80% compared with that in 2015.

However, in order to maintain a steady dividend, China Petroleum used the retained undistributed profits of previous years to pay dividends in 2016, and the dividend rate reached 137.43%. By 2018, the company’s profits have improved, the denominator has become larger, and the dividend rate has fallen.