Capital Monthly Report | The financing environment of housing enterprises has been accelerated, and Zhongliang Holdings has been listed (July 2019)

★ Focus on this month ★

"730 meeting" set the tone

The government accelerated the tightening of financing for housing enterprises.

At the 730th meeting of this month, the Political Bureau of the Central Committee once again reiterated the need to implement the long-term management mechanism of real estate, and proposed for the first time not to use real estate as a short-term means to stimulate the economy. This is the government’s latest statement on the real estate industry, and it is also a warning that the real estate is slightly overheated some time ago. In fact, before the meeting was set, the government had tightened the financing of housing enterprises several times in July: from 6 th to 10 th, the China Banking Regulatory Commission interviewed some trust companies about the problems in financing housing enterprises; On the 12th, the National Development and Reform Commission (NDRC) issued a notice on the relevant requirements for filing and registration of foreign debts issued by housing enterprises, which put forward higher requirements for housing enterprises to issue overseas debts. On the 29th, the central bank announced at the symposium on the adjustment and optimization of credit structure of banking financial institutions that it should strengthen supervision over the loan behavior of large-scale housing enterprises with high leverage. Under a series of government control, it is expected that the financing environment of housing enterprises will be mainly tightened in the second half of the year.

The amount of bonds issued by housing enterprises at home and abroad has risen sharply.

The financing cost has been reduced.

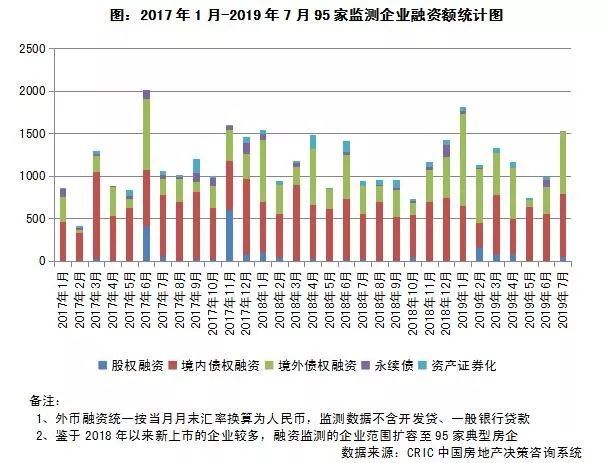

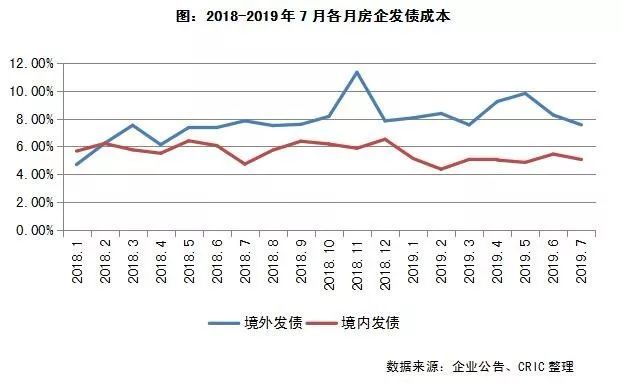

The total financing of 95 typical real estate enterprises this month was 153.446 billion yuan, up 55.3% from the previous month and 63.2% from the same period last year. Among them, the total amount of bonds issued by enterprises at home and abroad this month was 83.53 billion yuan, up 104.2% from the previous month, only lower than the level of bonds issued in January and March 2019. This month, the financing cost of housing enterprises issuing bonds was 6.86%, down 0.57 percentage points from the previous month; Among them, the financing cost of overseas bonds was 7.55%, which was 0.70 percentage points lower than that in June, mainly because a number of low-cost housing enterprises issued a large amount of bonds in July, which structurally lowered the financing cost.

Zhongliang Holdings officially went public.

There are 9 real estate companies and property companies to be listed.

On the 16th of this month, Zhongliang Holdings was officially listed, and Hehong Services under Hehong Real Estate was also listed on the 12th. No housing enterprises or property companies under the housing enterprises submitted listing applications. Therefore, as of the end of July, there were 6 real estate enterprises and 3 property companies owned by real estate enterprises waiting for IPO on the Hong Kong Stock Exchange.

China Jinmao introduced Ping An into the second largest shareholder through rights issue.

On 26th of this month, China Jinmao announced the introduction of Ping An as the second shareholder, and Ping An subscribed for 1.787 billion shares of Jinmao for about HK$ 8.6 billion. After the subscription, Jinmao newly issued 169 million shares, and the shares subscribed by Ping An accounted for about 15.20% of the enlarged issued share capital.

Produced by Kerry

Corporate bond issuance

Bond issuance: up 104% from the previous month, but overseas bond issuance is limited, and the future is not optimistic.

The total financing of 95 typical housing enterprises this month was 153.446 billion yuan, up 55.3% from the previous month and 63.2% from the same period last year. In terms of specific financing methods, domestic debt financing was 74.939 billion yuan, up 34.9% from the previous month; At the same time, the amount of overseas debt financing was 72.25 billion yuan, up 123% month-on-month, and the amount of overseas financing increased greatly month-on-month, only lower than that in January 2019.

Among them, the total amount of corporate bonds issued at home and abroad this month was 83.53 billion yuan, up 104.2% month-on-month, which was significantly higher than that in June, only lower than that in January and March 2019. In terms of specific financing methods, the issuance of overseas bonds was 58.93 billion yuan, up by 104.0% month-on-month. Among them, before the introduction of the new regulations on restricting overseas bond issuance on July 12, housing enterprises issued 16 overseas bonds totaling 39.6 billion yuan. After the introduction of the new regulations, housing enterprises issued 9 overseas bonds totaling 19.3 billion yuan. The introduction of the new regulations has restricted the overseas bond issuance of some enterprises, and the amount of overseas bond issuance of housing enterprises is expected to decrease slightly in the future. Domestic bonds increased by 104.9% month-on-month, of which corporate bonds increased by 99.3% month-on-month to 14.65 billion yuan, and medium-term notes increased by 260% month-on-month.

The financing cost this month was 6.86%, down 0.57 percentage points from the previous month; Among them, the financing cost of overseas bonds was 7.55%, which was 0.70% lower than that in June, mainly because a number of low-cost real estate enterprises issued a large amount of bonds in July, which reduced the financing cost structurally. For example, CNOOC Real Estate issued 2 billion Hong Kong dollars and 450 million US dollars of overseas bonds in July, with interest rates of 2.95% and 3.45% respectively, and China Jinmao issued 500 million US dollars of overseas priority notes with interest rate of only 4.25%. In 2019, as of July, the financing cost of new bonds in real estate enterprises was 7.18%, up by 0.71 percentage points over the whole year of 2018. Among them, the financing cost of overseas bonds reached 8.21%, an increase of 1.06 percentage points over 2018.

In terms of specific corporate performance, Shimao Real Estate issued the highest amount of bonds in July, with a total amount of 6.885 billion yuan. On July 9, Shimao issued a $1 billion overseas priority bill. The lowest financing cost this month is a RMB 1 billion ultra-short financing bond issued by Xiamen International Trade (600755), with an interest rate of 2.69%. In addition, the interest rates of HK$ 2 billion and US$ 450 million of overseas bonds issued by China Shipping are 2.95% and 3.45%, respectively. Among them, US dollar bonds have the lowest interest rate and the lowest spread for Chinese real estate enterprises in the same year, with a fixed interest rate of HK$ 2 billion for 55 years.

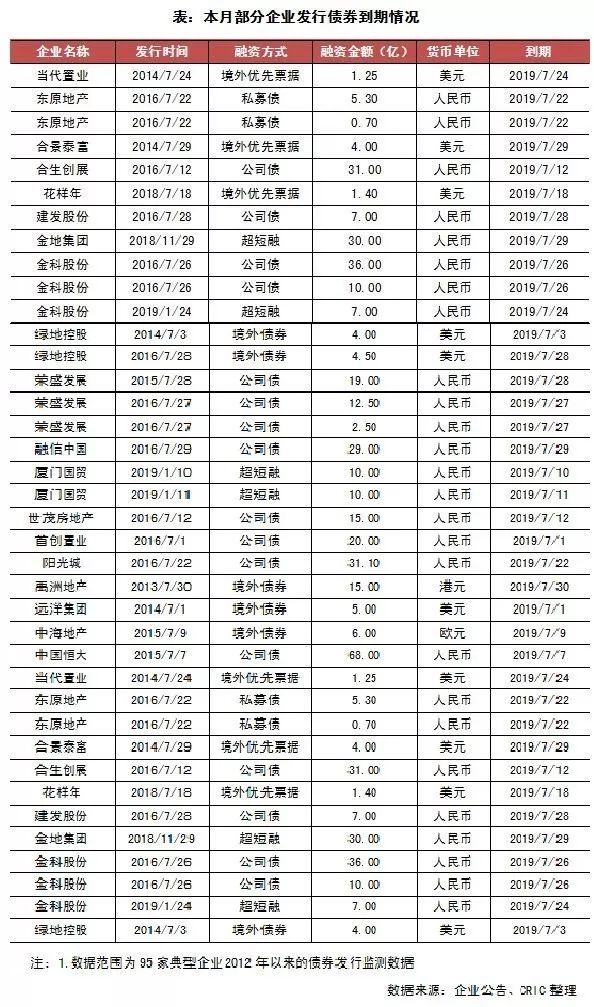

Term of bonds: 53.099 billion yuan of bonds due this month.

This month, there are 26 corporate bonds due from real estate enterprises, with a total amount of 53.099 billion yuan, and the highest maturity amount is 6.8 billion yuan of corporate bonds issued by China Evergrande in July 2015. In addition, the overseas bonds of 600 million euros issued by China Shipping Real Estate on July 9, 2015 are also scheduled to expire in July. In addition, three bonds of Jinke (000656) and Rong Sheng Development (002146) have also expired.

Pay attention in advance that there will be 14 bonds due in August 2019, with a total amount of 17 billion yuan. The enterprise with the highest single amount is a $450 million overseas priority bill issued by Lujin Infrastructure on August 9, 2016.

Listing and stock

Housing enterprises to be listed: there are 9 queuing housing enterprises and property companies.

No real estate enterprises submitted listing applications to the HKEx this month, and as Zhongliang Holdings was officially listed on the 16th, as of the end of July, there were six real estate enterprises waiting for IPO on the HKEx, namely Huijing Holdings, Hellenborg China Holdings, Aoshan Holdings, Xinli Holdings, Wanchuang International and Jingyi Mingbang.

As for the property management companies under the housing enterprises, no property companies submitted listing applications to the Hong Kong Stock Exchange this month. On the 2nd of this month, Yincheng Life Service under Yincheng International submitted a listing application to the Hong Kong Stock Exchange, and on the 12th, Hehong Service under Hehong Real Estate was officially listed. Therefore, as of the end of July, there are three property management companies under the real estate enterprises waiting for IPO on the Hong Kong Stock Exchange: Xinyuan Property Service, Blu-ray Garbo Service and Yincheng Life Service.

IPO and additional issuance: Zhongliang was successfully listed, and Jin Mao introduced Ping An as the second shareholder.

On the 16th of this month, Zhongliang Holdings was listed on the Hong Kong Stock Exchange at an offering price of HK$ 5.55 per share. According to this offering price, the net proceeds from the global offering are estimated to be about HK$ 2.773 billion. The completion of the listing of Zhongliang Holdings marks that all the top 30 large-scale housing enterprises have been listed, and it also allows Zhongliang to successfully enter the capital market. In 2018, Zhongliang’s net debt ratio was 58.1% and the weighted financing cost was 9.9%. After listing, enterprises can increase financing efforts and reduce financing costs, and can accelerate the development of enterprises with the help of capital.

As for the property management company under the real estate enterprise, Hehong Services under Hehong Real Estate was listed on the 12th this month, with a global sale of 100 million shares, with a net proceeds of HK$ 77.1 million. So far, in 2019, three property companies owned by real estate enterprises have successfully listed.

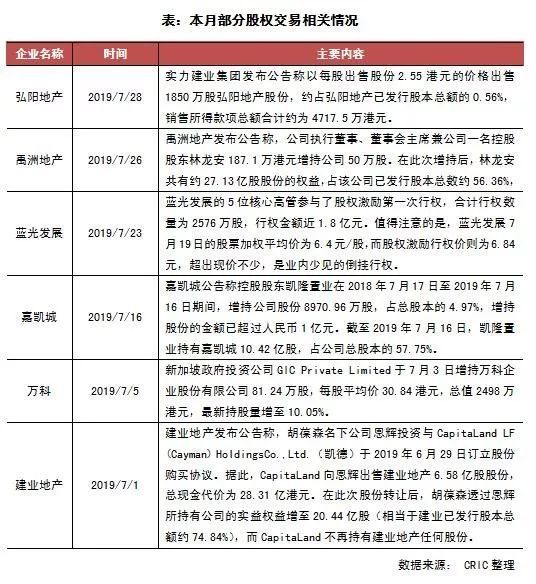

In terms of additional shares, this month, China Jinmao announced the introduction of Ping An as the second largest shareholder, which is another shareholding in large-scale housing enterprises after Ping An invested in Huaxia Happiness (600340) last year. This time, Ping An subscribed for about 1.787 billion shares of China Jinmao for about HK$ 8.6 billion. Immediately after the subscription, China Jinmao issued another 169 million shares, with a net financing of about HK$ 815 million. Therefore, the shares acquired by Ping An accounted for about 15.20% of the enlarged issued share capital. For China Jinmao, the introduction of Ping An, a financial giant, can not only help enterprises to bring more cooperation opportunities, but more importantly, it can broaden the financing opportunities of enterprises in disguise, open channels for enterprise funds and maintain the stability of enterprise capital chain under the situation of continuous tightening of financing.

On the 30th of this month, Zhengrong Group announced the completion of placing about 245 million shares at a price of HK$ 4.95 per share, accounting for about 5.60% of the issued share capital of the company after allotment and subscription. The net proceeds from this Zhengrong rights issue financing are about HK$ 1.199 billion, which will be used for possible future investment purposes and as general working capital.

Changes in equity: Jianye stock held by Kaide clearance.

This month, a number of real estate enterprises have seen shareholders increase their holdings and reduce their holdings of the company’s shares. At the beginning of the month, CapitaLand cleared its shares in Jianye Real Estate and sold them all to Enhui Investment under the name of Hu Baosen. This time, CapitaLand’s clearance of Jianye shares is mainly due to the long-term development of Jianye Real Estate in Henan Province, which is outside the core urban agglomeration of CapitaLand’s layout. Stripping investment in Jianye can enable CapitaLand to reallocate capital in its core business and invest in other opportunities, which is the need of CapitaLand’s strategic adjustment.

Stock price changes: the performance of real estate stocks was relatively weak throughout the month.

This month, the overall performance of real estate stocks was weak, and less than 40% of real estate stocks in both A shares and H shares rose in the whole month. In terms of H-shares, Baolong Real Estate has a relatively large increase this month, with a monthly increase of 22.82%. Except for a small consolidation at the end of the month, it is basically in an upward channel for the whole month. This is mainly because Deutsche Bank gave Baolong a "buy rating" for the first time at the end of June, and it was also the fifth institution to give Baolong Real Estate a "buy rating" after the release of Baolong’s 2018 financial report, following Citigroup, Dahua Jixian, Agricultural Bank of China International and Southwest Securities (600369), which greatly boosted market confidence.

In terms of A-share housing enterprises, the share price of Daming City (600094) experienced two waves of continuous rise in the first week and the middle of this month. Although the overall real estate stocks suffered heavy losses at the end of the month, the overall increase still reached 21.78% in July, which was a big increase among real estate stocks.

Other capital operation

There is little cooperation between housing enterprises and financial institutions this month. It is worth mentioning that China Aoyuan announced on the 19th that it plans to acquire 13.86% shares of Centennial Life for 3.262 billion yuan, which will become the largest shareholder of Centennial Life after the transaction is completed. In December 2018, Greentown announced that it would acquire 11.55% shares of Centennial Life Insurance for 2.718 billion yuan and gain its control. If the acquisition of Aoyuan landed, it would mean that Greentown would lose control of Centennial Life Insurance. After controlling Centennial Life, in addition to obtaining a financial platform, Aoyuan and Centennial Life can also provide potential opportunities for mutual cooperation in health and wellness industries, which will help both parties to better play their strategic synergy and complementary advantages in business segments, customer resources and customer experience.

This article first appeared on WeChat WeChat official account: Research on Kerui Real Estate. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.