The game is back!

Every edited: Zhao Yun

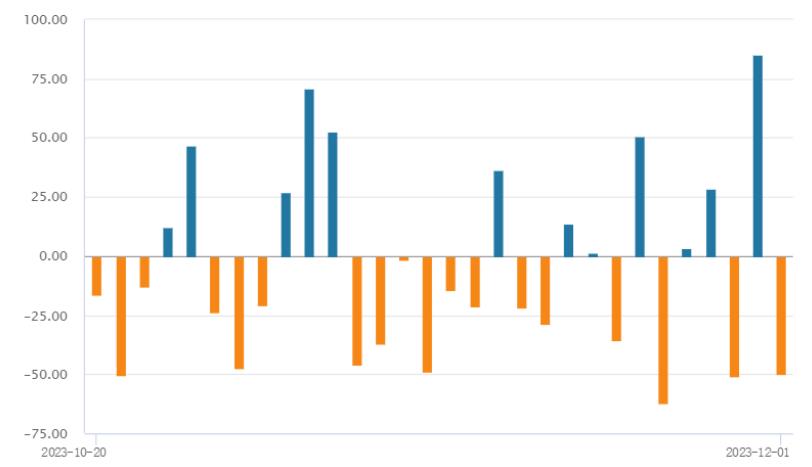

On December 1, the three major indexes of A-shares fluctuated and sorted out. As of the close, the Shanghai Composite Index rose by 0.07% to close at 3031.64 points. Shenzhen Component Index fell 0.07% to close at 9720.57 points; The growth enterprise market index rose 0.19% to close at 1926.28 points. In terms of industry sectors, the TMT tracks such as games, education, cultural media, Internet services, software development and communication services rose collectively, and the AI application side strengthened collectively, while the short drama and game sectors continued to be strong. Motors, auto parts, airports and general equipment sectors were among the top losers.

In the afternoon, after the news that the state-owned capital operation company entered the market to buy ETF came out, the index ushered in a turning point, with the Chinese prefix taking the lead, followed by AI+ dreaming back to the first half of the year, and the application side set off a daily limit. On December 1, the Shanghai and Shenzhen stock exchanges traded 834.1 billion yuan. In terms of northbound funds, Shanghai Stock Connect sold 4.062 billion yuan and Shenzhen Stock Connect sold 935 million yuan, and the two cities sold 4.997 billion yuan.

Source: Wind

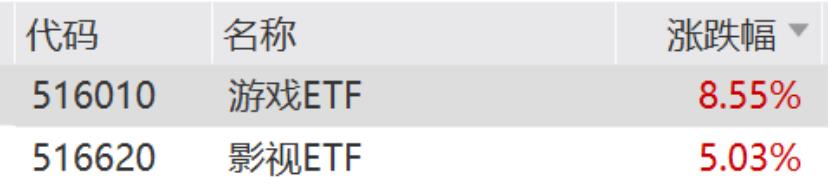

On December 1st, the game ETF(516010) rose by 8.55%, and the movie ETF(516620) rose by 5.03%.

Source: wind

In the news, AIGC tools such as AI+ video quickly landed. At the beginning of the year, HeyGen launched, which can help users create promotional videos through AI digital people. Since Runway released Gen-2 in early November, AI video tools such as MetaEmuVideo, Byte PixelDance, and StableVideoDiffusion were released on 16th and 21st. On November 28th, Pika, an AI startup, announced that Pika1.0, its AI video generation software, launched a major upgrade and officially opened an early beta version after more than four months of internal community testing, which quickly became popular on major social media.

A leading A-share game company officially released the "Tiangong SkyAgents" platform on December 1st. On the Tiangong SkyAgents platform, users can deploy their own AIAgents in a few minutes through natural language and simple operation without code programming, and complete many personal tailor needs such as industry research report, document filling, trademark design, and even fitness plan and travel flight reservation. A leading A-share game company is also developing a series of "Three-body" games, and plans to build a large model of the domestic game industry with Yuncong Technology.

Tencent’s companies issued a "script solicitation order" to enter the short drama industry. The platform promises to bring 15,000-50,000 guaranteed remuneration to the authors, and a maximum of 2% of the running accounts. Reading Group has unified requirements and regulations in four aspects: content standard, original submission requirements, adaptation submission requirements and submission instructions. The short play market has entered the stage of a hundred flowers blooming. The platform with rich IP reserves and strong script development ability is helpful to grasp the audience’s aesthetics, help the writers to create and adapt the content, pave the way for the future short play content, and is expected to seize the market share in advance. The game sector with fundamental advantages can be given priority.

In terms of film and television, the recent release of two high-topic films has led to the marginal recovery of the film market. "I am a mountain" has been searched in Weibo many times, and the suspense film Across the Furious Sea is the second film with a box office forecast exceeding 500 million after the National Day file. Driven by this, the weekend box office is showing a marginal improvement trend, and the Saturday/Sunday box office has reached the highest since the National Day file. There are still many blockbuster films released in December, which is expected to undertake a relatively high enthusiasm for watching movies, and the film market is expected to continue to recover. It is estimated that there is still room for recovery in the film market in 2024, which is expected to grow steadily to 58-60 billion yuan, basically returning to the level of 2019 (64.266 billion yuan).

At the same time, the game film and television industry is the most certain direction for AIGC to reduce costs and increase efficiency. With the accelerated investment in the industry, industry changes such as reducing costs and increasing efficiency and playing innovation will be gradually reflected. Under the normalization of the version number, the supply cycle of the game industry is gradually opened; The audience’s willingness to watch movies rebounded, the demand for film and television picked up, and the prosperity of the game and film industry continued to rise. After pre-adjustment, the cost performance of plate investment has improved.

From the catalyst point of view, the rapid landing of AI+ video (pika, heygen), the expected release of Apple MR, and the new increment of AR glasses, the media has a lot to watch in the New Year’s market. The market space of the industry is still relatively broad, and it has certain allocation value after the callback. We can continue to pay attention to the investment opportunities of game ETF(516010), film ETF(516620) and other related targets.

Both the software and computer sectors achieved good gains that day, with the software ETF(515230) closing up by 3.12% and the computer ETF(512720) closing up by 2.89%.

Source: Wind

From the policy point of view, the computer software sector bears the important mission of the transition from industrial economy to digital economy. Report to the 20th CPC National Congress of the Party has drawn a grand blueprint for the deep integration of digital economy and real economy. At present, the digital transformation of manufacturing industry has become the general trend. With the infiltration and integration of new generation information technologies such as big data, artificial intelligence and blockchain into manufacturing industry, the value of data elements has been further released. The computer software sector plays a decisive role in promoting business process transformation and promoting fundamental changes in production methods, organizational forms and business models of enterprises.

A detailed analysis of the subdivision direction of the computer software sector shows that artificial intelligence is a main line with high certainty at present, and the world is waiting for highly active AI applications to achieve a "closed loop", thus driving the next round of growth from computing power to application penetration. In the domestic market, data elements continue to brew. In April 2020, China explicitly listed data elements as new production factors for the first time. By 2H23, the data industry has ushered in a series of top-level design catalysis, and data elements are expected to become an important main line of the computer software sector.

From the perspective of supply and demand, Xinchuang and the digitalization of central state-owned enterprises are expected to lead the computer software sector to open up new growth space. Under the background of weak downstream digitalization demand and delayed digitalization expenditure of SME customers in 2023, the digitalization investment of central state-owned enterprises still shows some resilience in the big environment. With the release of new demand for digitalization and the promotion of industry localization, the digitalization investment of central state-owned enterprises is expected to continue marginal upward in the following quarter, leading the computer software market to open up long-term and stable growth space.

Interested partners can pay attention to the software ETF(515230) and the computer ETF(512720) to grasp the overall investment opportunities in the computer and software fields, or they can pay attention to the Xinchuang ETF(159537) to lay out the investment opportunities for information technology application innovation with one click, but they should also be wary of the fluctuation risk because the short-term orders are less than expected.

Risk warning:

Investors should fully understand the difference between fixed-term investment and lump-sum withdrawal of funds. Regular fixed investment is a simple and easy way to guide investors to make long-term investment and average investment cost. However, fixed-term investment can not avoid the inherent risks of fund investment, can not guarantee investors to obtain income, and is not an equivalent financial management method to replace savings. Both stock ETF/LOF funds are securities investment funds with higher expected risks and expected returns, and their expected returns and expected risks are higher than those of hybrid funds, bond funds and money market funds. Fund assets invested in science and technology innovation board and GEM stocks will face unique risks caused by differences in investment targets, market systems and trading rules, so investors should pay attention to them. The short-term ups and downs of the sector/fund are only used as auxiliary materials for the analysis of the article, for reference only, and do not constitute a guarantee for the fund’s performance. The short-term performance of individual stocks mentioned in this paper is for reference only, and does not constitute a stock recommendation, nor does it constitute a forecast and guarantee for the performance of the fund. The above views are for reference only and do not constitute investment suggestions or commitments. If you need to buy related fund products, please pay attention to the relevant regulations on investor suitability management, make risk assessment in advance, and buy fund products with matching risk levels according to your own risk tolerance. The fund is risky and needs to be cautious in investment.

national business daily