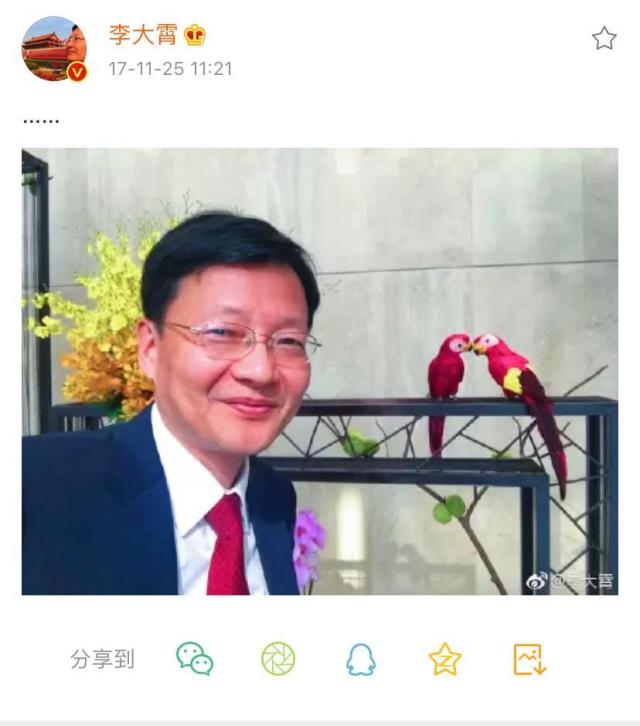

Li Daxiao decodes his own Weibo picture: cherry on the top of the earth "should run away" parrot means "baby should cover up when he grows up"

Source: Financial website

Author: Qi Ning

On November 30th, the 2019 Snowball Carnival with the theme of "Ten Years as One" was held in Guangzhou Pearl River.

Li Daxiao, chief economist of Yingda Securities, attended the special meeting and delivered a speech on "Ten Perspectives of Investment Opportunities in the Next Decade".

Li Daxiao said, "The first bull market in China, which is the slowest, longest and can test the level of every investor, has arrived", and the fifth bull market in China began at 2440.

Li Daxiao talked about future investment from 10 perspectives, such as the rebound of RMB against the US dollar, MSCI’s expansion of A-share weight according to the established rhythm, the CSRC’s promotion of long-term funds to enter the market, the opening of bank wealth management subsidiaries and the fact that domestic GDP growth is in the forefront of major economies in the world. He said that all domestic residents used to buy houses, and they will buy bonds, stocks and wealth management products in the future.

Li Daxiao believes that the research market is the first to see where the gold mine is, the first gold mine in A shares is in real estate, the second gold mine is in banks, the third gold mine is in non-bank finance, and the fourth gold mine is in infrastructure.

At the end of the speech, Li Daxiao also decoded his own picture of Weibo: the top of the earth (June 14, 2015), cherry means "escape", and the parrot picture released in 2017 means "the baby should be covered when it grows up" …

The following is the full text of Li Daxiao’s speech:

The bull market is here! For the first time, the China stock market is the slowest, longest and most able to test the level of every investor. This bull market started from 2440. Today, I will report to all golfers in detail what his logic is and why he made such a judgment.

The global risk appetite is rising, which is a big trend. We have 17 trillion bonds with negative yields around the world, and now they are flowing out. Where are they flowing out? Flowing to the stock market, we look at three countries. The first is Germany, where the yield of negative-yielding bonds is rising, the second is the United States, and the third is China. Now it is rising, and the funds in the bond market are flowing into the stock market.

The interest rate cut by the Federal Reserve has come to an end, and the unemployment rate in the United States has hit a 50-year low. We also see that the interest rate level of the global market, including the Federal Reserve and the European Central Bank, is at a historical low level. We also see that the price of gold has fallen below $1,500. What does this mean? It shows that risk aversion is decreasing. What does this trend mean? It shows that those who used gold as a safe haven began to understand that gold has no P/E ratio. We also saw that the stock markets in Europe and the United States continued to strengthen, including the Dow Jones index, the Nasdaq index and the Standard & Poor’s index, and the DAX index in Germany and France.

The RMB exchange rate has been rising recently. What does the rising exchange rate mean? It means that the fun is coming!

MSCI has expanded its capacity according to regulations, and now it is 20%. I predict that in the near future, MSCI, FTSE Russell and Standard & Poor’s will expand their capacity competitively, and foreign capital will continue to flow into the stock market. Tell you a data, the proportion of foreign capital in A shares is only 2.8%, and that of bonds is only about 3%. Is it possible to expand to 10%, 20% or even 30% in the future? It’s entirely possible. We can see the capital flowing into the stock market from the north. Comrades, hold on to the good stocks in your hands.

Don’t be scared by yesterday’s decline. Foreign investors are eager to buy good stocks. We see that the CSRC is promoting domestic medium and long-term funds to enter the market. I will tell you a situation, such as pensions, insurance funds and social security funds, which are all low-allocated, and some are even zero-allocated. This situation will change soon in the future. We see that the allocation of insurance funds is only 12%, and its upper limit is 30%. Now we are studying how to expand this ceiling. We should see that the financial subsidiaries of banks are entering the market one after another, with large troops behind.

The growth rate of domestic GDP is still at the forefront of major economies in the world. Just now, Dr. Pan Xiangdong also said that although we are on the decline, compared with other major economies, China’s growth rate is still two to three times. We also see that the wealth ratio of domestic residents is changing, and financial assets will rise in the future. This trend has just begun.

I’m telling you, it’s just beginning. What do you mean? It turns out that all domestic residents buy houses, and will buy bonds, stocks and wealth management products in the future.

What is better to buy?

First, I’m buying a house in Shenzhen and Beijing, and its rental yield is 1.7%. However, we can see the index here and buy the Hang Seng State-owned ETF. The dividend yield is 3.9%, which is the first recommendation. The second recommendation is SSE 50ETF. The third recommendation is the Shanghai and Shenzhen 300ETF, and the dividend yield is better than the rent yield!

We look at four cities, Shenzhen has quietly started, Shanghai is ready to move, Guangzhou is still wandering, Beijing is still adjusting, where is the whole country? Look at Shenzhen first. Shenzhen is the weather vane, and Guangzhou will have money in the future. Of course, the potential of Shanghai and Beijing can not be ignored.

Let me tell you what will happen to the market in 2020, which is the most valuable, right?

Let me tell you, what is the password for 29 years? The first password is at 325 o’clock, and I named it the policy bottom. The second point is in 998, and I used two words. This place needs to be planted. The third is that the once-in-a-century financial crisis has brought us a once-in-a-century investment opportunity. I am here to say that 1664 needs courage. The fourth place is the diamond bottom where I was scolded for three years. I am saddened here. I used all my energy in this place to appeal that our country’s pension should enter the market at this diamond bottom. Comrades, the first three points, the pension can’t enter, the V-shaped bottom, only the diamond bottom, the pension can enter the market, but unfortunately I didn’t understand. It’s not too late. The fifth bottom, 2850, baby bottom, fell below. I named it baby diapers, and 2638 fell below again. I named it the end of the year. Aren’t you wrong? Why is it getting lower and lower? However, it is very correct to observe the SSE 50 index, because the baby has grown into a teenager and thrived.

Let’s take a look again. Let’s look at the trend of the whole market. The first top is 1559 points, and the second top is 2245 points. The third place, I put forward the need to be indifferent in 6124. The fourth place is the top of the earth, where I have been calling for a long time. I can’t buy stocks. This is a height that the earth has never been to, and I absolutely can’t buy stocks. Unfortunately, no one listens to me.

Now is the fifth bull market, starting at 2440, it is the fifth bull market in China stock market, and 2440 is a historic bottom.

I’ll tell you another secret. How can I tell the bottom? Ten times the PE is the bottom, and you can judge the bottom next time you encounter the corresponding situation. Where are the opportunities? Where are the risks? Risk accumulates at 29 times and opportunities arise at 9.31 times. Comrades, where are the historic opportunities? These are risks and these are opportunities. Where are the opportunities? The opportunity is in the blue line, where is the risk? The risk is on the purple line. The purple line is the second new share.

This is the status quo, and there may be the future. How can we identify the market? How to judge the market? We see the contrast between China and the United States, and we also see what good opportunities are there. There are "Ten Predictions" published in 2020. First, there will be an asset shortage in 2020. Second, there will be more stocks than bonds. Third, there will be a large number of delisting companies. Fourth, the scale of refinancing will increase. Fifth, the registration system. Sixth, foreign capital will enter the market in large numbers. Seventh, domestic long-term funds will enter the market. Eighth, the proportion of A shares in major indexes will increase. Ninth, it is Pay attention to where the profit is. The biggest profit, I think, is real estate, because it has an output of 16 trillion yuan, and the output of 16 trillion yuan is calculated by 10%, and it has a profit of 1.6 trillion yuan, just because most real estate enterprises are not in A shares, but in Hong Kong stocks, so it is not counted, and many real estate enterprises are not listed. Therefore, the research market first looks at where the gold mine is, the first gold mine is in real estate, the second gold mine is in banks, the third gold mine is in non-bank finance, and the fourth gold mine is in infrastructure.

How to choose the largest gold mine real estate, choose the fastest-growing enterprises, leading monopoly enterprises, and choose enterprises with upward rankings year by year. Second, we choose non-bank finance. How to choose non-bank finance? The first choice is insurance. Insurance is greater than securities and trust. What is insurance? Choose peace. Third, choose the bank, what does the bank choose? Choose China Merchants Bank. Also, we choose enterprises that increase their holdings in the secondary market on a large scale, not those that reduce their holdings in the secondary market on a large scale. And let’s look at the global valuation comparison. Globally, the first one is the Russian market, but this market is outside the global economy. We exclude it. The first one recommends Hang Seng State-owned Enterprises, the second one recommends Hang Seng Index, the third one recommends SSE 50, and the fourth one recommends CSI 300. They are more attractive than other markets in terms of valuation, and I think this attraction will be the object of global capital allocation in the future. In terms of operation: First, in 2020, stocks will be larger than bonds, and five types of black risks will emerge. Second, allocate banks’ non-bank finance, real estate, infrastructure and consumption. Pay attention to the once-in-a-lifetime investment opportunities in Hong Kong stocks. There are two main lines in the Hong Kong market, one is the investment opportunities in traditional industries, the other is the investment opportunities after the thorough adjustment of emerging industries. Not many people bought my book "Li Daxiao Investment Strategy". Why did I come here? Why do we come to snowball every year? Let me tell you a truth. People have lived a circle in the world, some have made a little money, some have not, and that’s all.But I think some people are different. Some people left a piece of music to the world, some people left a building to the world, some people left some beauty to the world, and some people left a beautiful impression in everyone’s hearts and minds. I think these people live more meaningfully.

What is my password for Weibo? Every picture has a password. At the top of the earth, on June 14th, 2015, what fruit was it? Cherry. What do you mean? Should "run away", that is, the audience in Guangzhou did not understand, he said that Miss Li was a cherry! Comrades, this baby is growing sturdily. It’s the end of the year and the baby has grown up. What kind of bird is this? Parrot, what do you mean? It should be covered. I firmly believe that who will make money in the future? Patriots earn!

Finally, please read this sentence with me, and meditate at home three times a day. It works wonders. Let’s help me read it together: Be a good person, buy good stocks and get good results.

Reporting/feedback