Zheng Shaozong/Wen

The excavation of Hanzhong Mountain Mausoleum in Mancheng, Hebei Province was many years ago, when I was only 30 years old and was the only archaeological institution in Hebei Province — — The provincial cultural relics team works in Baoding, which is only 20 kilometers away from the city. Looking back on the excavation scene of that year, I can remember it vividly and vividly.

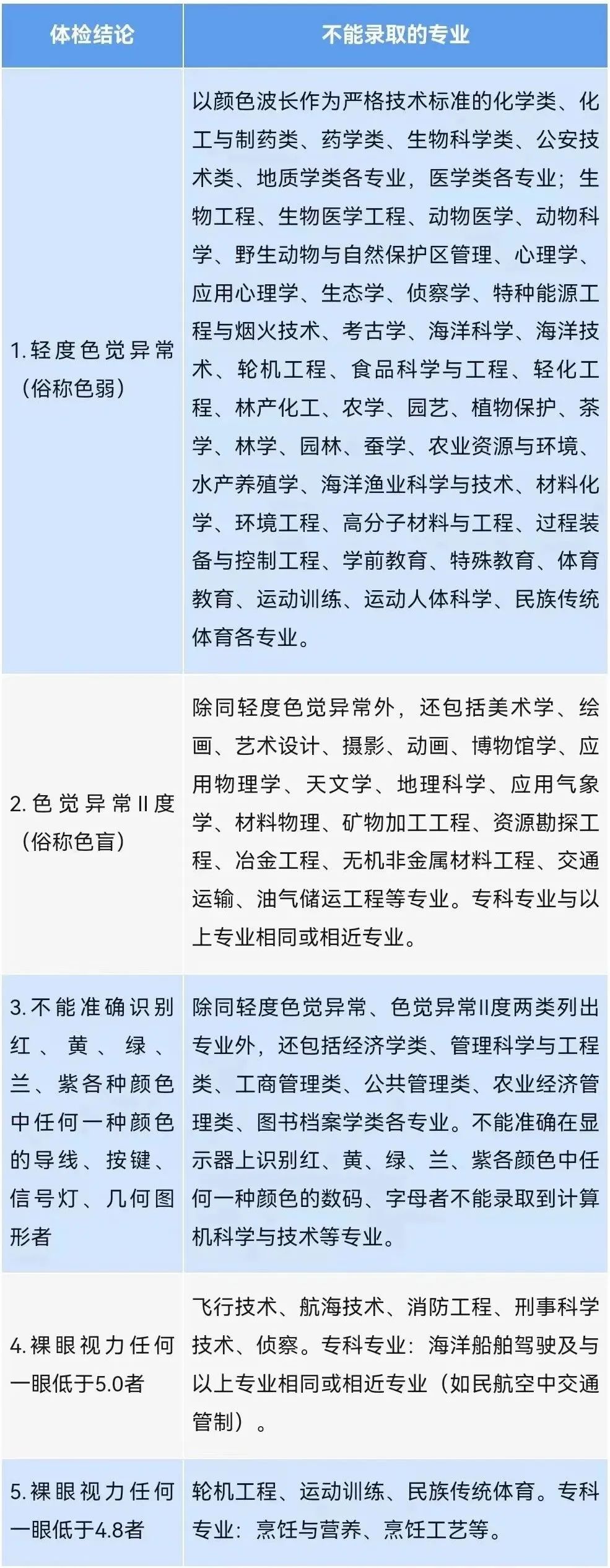

▲In 154 BC, Emperor Liu Qi of the Han Dynasty named Liu Sheng, the illegitimate son, as the King of Zhongshan, where he ruled Lunu County (now Dingzhou, Hebei Province). The picture shows the schematic diagram of the Han Dynasty vassal states.

Discover an ancient tomb

In the summer of 1968, it was the third year of the "Cultural Revolution", when Baoding’s warfare was famous throughout the country. There are nearly 40 people in the cultural relics team in Hebei Province, and they are also caught in a serious factional struggle. The leading group is paralyzed, and most people are too busy fighting between the two factions to carry out their normal work.

One day, the Provincial Revolutionary Committee informed me and Comrade Sun Dehai to go to Shijiazhuang, the provincial capital, immediately to have important work. The next day, Zhang Tianfu and Du Rongquan, the political department of the Provincial Revolutionary Committee, met with us and said that the garrison in the city had found a huge ancient tomb in Nanling Mountain and asked us to go to the city as soon as possible to do a good job in the investigation and protection of the ancient tomb.

On May 28th, Du Rongquan and Zhang Zuliu, director of the Political Department of the Sixty Armed Forces, rushed to the city with us. The struggle between the two factions in Baoding area is very sharp, and there are strongholds of the two factions everywhere. Because the two garrison troops each support one faction, the brand on the military vehicle has become a sign to identify the factions. We are sitting in the 212 Jeep, and the young driver is a very smart soldier. We have to change the license plate every time we walk, because the rebels only recognize the license plate but not the person, and they belong to their own faction, otherwise they will hijack the car and copy people. Almost every walk, people come out to stop and check, and almost every village has fortifications of warfare. It is very difficult to walk 200 kilometers from Shijiazhuang to Mancheng. After crossing Anguo, the car and people were detained. Several cadres in the village found that the license plate was a military license plate, but only Zhang Zuliu was wearing a military uniform. They were very vigilant and said that the group even took the car for one night. The driver quietly said to Zhang Zuliu, "We can’t let them detain the car, otherwise the consequences will be unimaginable." Zhang Zuliu also broke out in a cold sweat. "We went to the city to perform an urgent task, so please cooperate." After several twists and turns and repeated explanations, it was finally released. The group didn’t even attend to lunch, and it was near dusk when they arrived in Baoding.

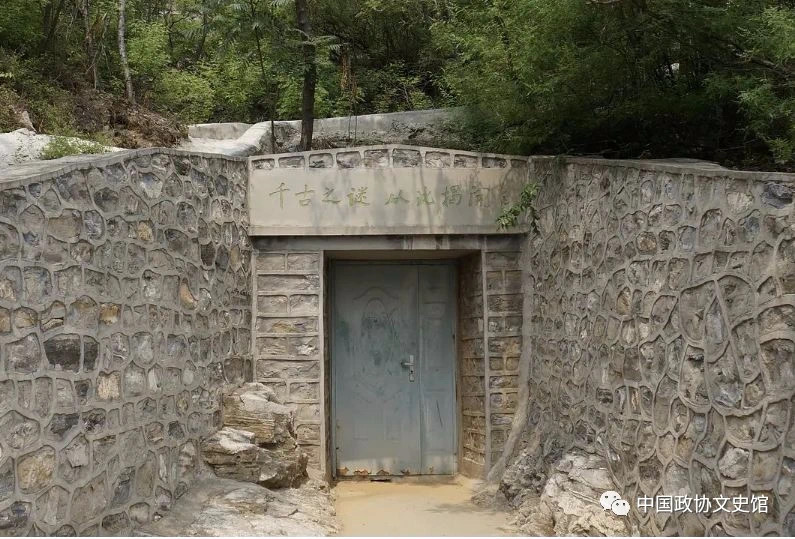

▲Panoramic view of the mausoleum of Han Dynasty in Mancheng

On May 29th, we arrived at the 4749 troops station in Mancheng. Take a break, that is, go straight to the site of Lingshan ancient tomb in the southwest of the county seat. The streets of the city are very depressed, and there are few pedestrians on the road because of the fighting. It’s a warm day. Looking at Lingshan from the field, it’s like a huge and majestic plush chair surrounding the main peak, and the main peak and the North and South Lingshan are like a dignified and quiet arhat, which is very solemn. We climbed the mountain path to the north of the east side of the main peak to the south of the main peak of Lingshan Mountain, and arrived at the entrance of the tunnel under construction. There were soldiers guarding the entrance day and night, and there was a military dog next to it. The project of sheltering the cave entrance at the front of Taihang Mountain has been stopped due to the discovery of tombs. We were eager to know the situation of the tomb, so we called a small warrior forum to know the whole story of the discovery of the tomb.

A major archaeological discovery that shocked the world

It was already very hot in the city at that time, but it was still cold in the morning and evening. The garrison was still under intense construction. There was a happy track at the southern end of the main peak, which was paved when the tomb was repaired more than 2,000 years ago. This happy track twists and turns to the south to reach the foot of Nanling Mountain. The mountain is covered with thorns, chrysanthemums, cloves, Chinese Pulsatilla and low shrubs. A tunnel is dug from east to west on an exposed cliff face south of the main peak, that is, on the west side of Happy Valley Road, to build a shelter room at the front of the mountain. The company commander Kou Junlin and platoon leader Hu Chonglin are responsible for the project.

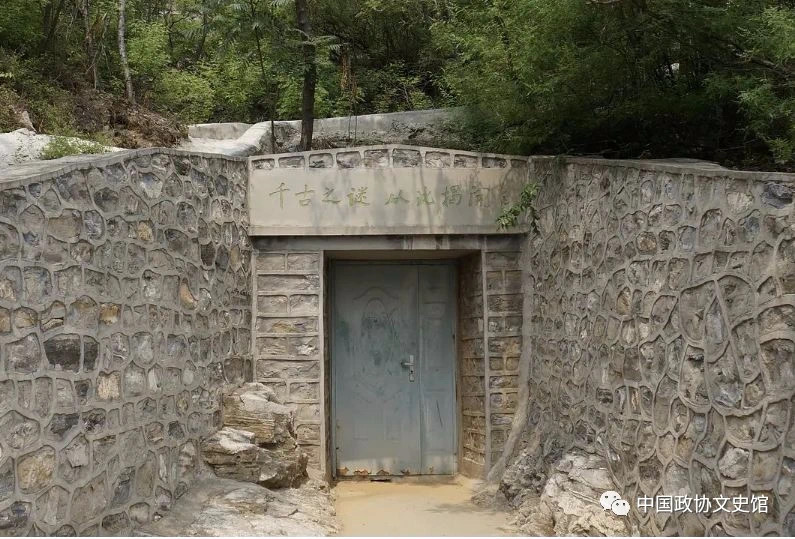

▲The Han Tomb in Mancheng was found behind this door.

The soldier said that at 11: 00 midnight on May 23, 1968, he was dug to a place 2.5 meters high and 24 meters deep. After the cannon sounded, he found that a hole with a diameter of about 1.5 meters collapsed under the north of the end of the tunnel, and the collapsed rock fell into the hole along the hole. The soldiers immediately reported the news to the company. The company commander Kou Junlin rushed to the construction site from the station several kilometers away overnight, and went into the cave to investigate with the platoon leader Hu Chonglin and the soldier Cao Dianji. They tied a long rope around their waist, and the other end of the rope was led by the soldiers who stayed in the tunnel to avoid being lost in the deep hole and unable to turn around. Entering the entrance of the cave, firstly, it is a circular arch-shaped cylindrical hole, the ground is covered with big tiles, and a large number of utensils, horse skulls and dog bones are pressed under it. Further inside, it is a large-scale hole with a diameter of more than 20 meters and a height of about 7 meters, which can accommodate more than 1,000 people, just like an underground palace. When the soldiers returned to the tunnel entrance by the original road, the company commander immediately stopped the construction, assigned special personnel to guard the scene, and they were not allowed to re-enter. At the same time, they reported to their superiors by telephone.

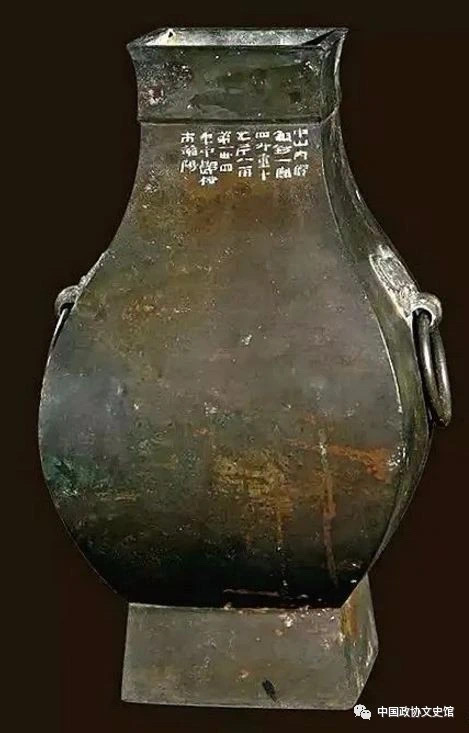

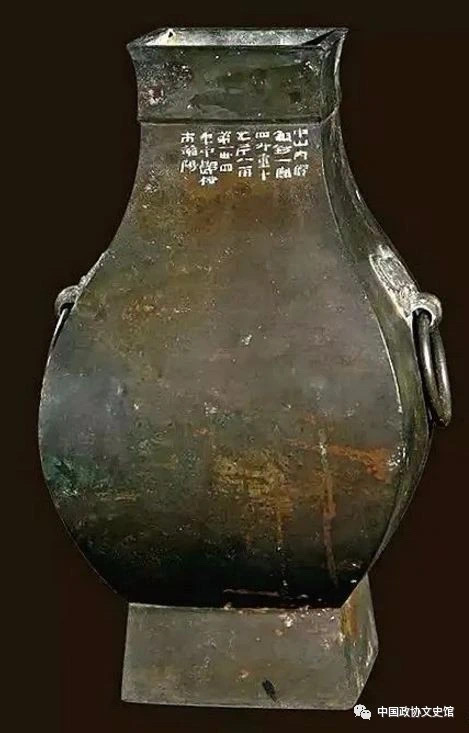

After listening to the introduction, we look extremely nervous and excited. What we are nervous about is the heavy workload, heavy tasks, too few people and urgent projects. I am excited that it is the first time for me to come to such a large tomb. I also feel that the cultural relics and burial are unknown and somewhat mysterious. The gold-plated bronze wok and several gold-plated vehicles with the inscription "Zhongshan Neifu" and "Thirty-nine Years" taken out by the soldiers from the tomb attracted our great attention. In 1966, I excavated the tomb of Zhongshan Wang family in the Western Han Dynasty in Sanxian Mountain in Dingxian County, and also unearthed the bronze bell and the wrong gold and silver chariots and horses in the Inner House of Zhongshan. So when I saw these artifacts, I realized that it might be a high-level noble tomb of Zhongshan State in the Western Han Dynasty. The bronze ware was cast by the inner government, which manages the daily life of King Zhongshan, and has a time, which gives us a preliminary idea.

▲A bronze tablet engraved with the words "Zhongshan Neifu" unearthed from Han tombs in Mancheng.

Under the guidance of Kou Junlin and others, our party went west along the 24-meter-long tunnel, which was more than one person high. It was very damp and cold in the cave, and white steam rose along the hole. First, a soldier went down, and we also went down from the hole one after another, and landed at 1.5 meters, which is the southernmost point of the south ear chamber of Liu Sheng’s tomb, King Jing of Zhongshan.

The huge cave is dark, and the visibility is only about 2 meters with large flashlights. Several flashlights can be gathered together to see the ground situation in the cave. We walked north along the long hole, and from time to time there was a "tick-tock" and "tick-tock" dripping sound in the dark, which was very frightening. We were afraid and nervous inside, as if we had entered another world, and we could hear nothing but the dripping sound. The underwater sound flows down from the cracks in the mountain gap at the top of the cave and drops on the cliff surface and the big tile. The most worrying thing is the sudden collapse of the cave roof or the fear that there will be a big snake in the cave to hurt people. But nothing ventured, nothing gained, no matter how dangerous it is.

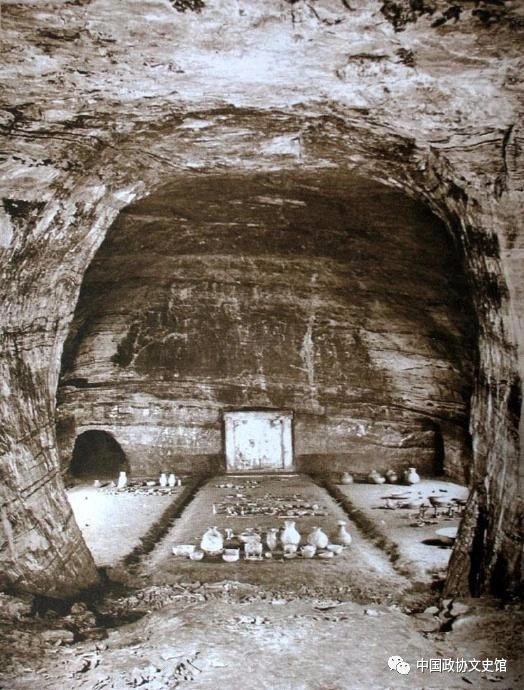

▲The north ear room of Liu Sheng’s tomb is a storehouse for food.

We advance cautiously from south to north, lest we step on the cultural relics under our feet. The first thing I saw was a large number of slab tiles and tube tiles, which were stacked layer by layer, which seemed to be symmetrical in the north and south. The tiles were covered with rope patterns and chord patterns. This large tile was 55 cm long and 35-mdash wide. 40 cm, arranged in an orderly way, it seems that a huge roof has just collapsed. Although it is a little messy, it can be seen that the original arrangement law is mainly symmetrical between north and south, and the middle seems to be the roof. We walked along the two sides of the cave. When we gently uncovered a small part of the tiles, dazzling golden vehicles were exposed below, including gold-plated car frames, bow caps, car covers and so on. Followed by the orderly arrangement of the horse’s head bones, these horses are buried in order, the muscles have long rotted, and now only the bones are left, but the horse’s winding head and gold-plated bodyguard are placed in front of the horse’s head, which should be conscious killing and martyrdom. About 15 meters north, all you can see are real chariots and horses, and about 5 meters north, which is equivalent to the position of the front room (aisle). In addition to the gold-plated silver ornaments of luxury cars, a large number of dog skeletons have been found, which are also covered by collapsed tiles and slabs.

Continuing northward from the tunnel, we entered a large north-south cave room, about 15 meters long and 4 meters high. This is a huge kitchen. The cave has a slightly higher terrain. A horse head and a water stone mill were found at the entrance, and there was a huge copper funnel-shaped grinding disc under the mill. On both sides of the cave, there are iron furnaces, pottery pots, retort, and rows of huge wine jars, on which the grade of wine is written in red ink. On the lid of the jar, there is a stalactite column about 5 cm high formed by dripping water from the top of the cave, which shows that it has been formed for a long time. On the north side, there are layers of big tiles, and on the lower side, there are mountains of pottery.

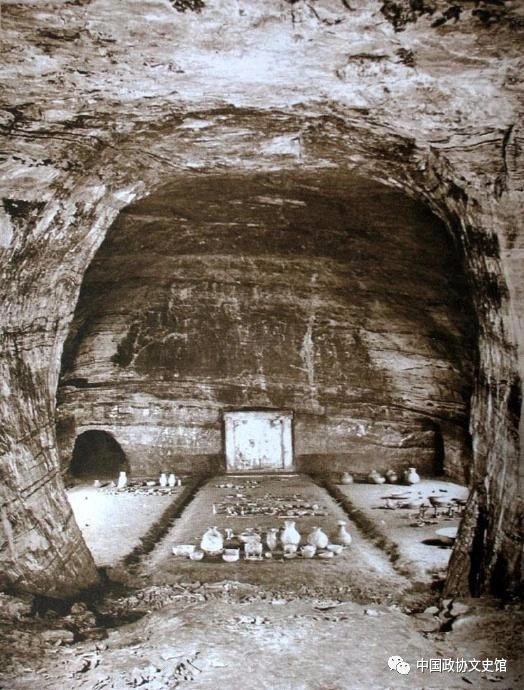

▲Liu Sheng’s tomb room

From then on, I returned to the cross-shaped front room and tunnel, turned to the west, passed a seepage well, and the terrain was even lower, entering a large cave with a dome top of more than 200 square meters — — Middle room. The middle room is about 6 meters high, and it is a bare frame supported by a huge wooden structure. Because the wooden frame is decayed, the big tiles on the roof fall to the inner surface of the cave, and the layers are stacked naturally and orderly. It can be seen that the house vouchers are north-south, and some precious gold, silver or gold-plated bronzes, jade articles and lacquerware are buried in the tiles in disorder. The central room is surrounded by a drainage ditch, with a square groove on the wall for installing the frame. The ground is divided into three areas: the central area, the southern area and the northern area. The west wall is exposed with a glittering snowflake stone masonry stone gate, which should be the "inner bedroom" for burying the owner of the tomb. There is also an arched cloister-shaped semi-circular cave on both sides of the stone gate, in which no important cultural relics are found, only a few pieces of pottery are found. There are many relics in the middle room. The gold-plated bronze cup (wok) taken out from the middle room is engraved with an inscription on the mouth: "The bronze wok of Zhongshan Neifu, with a capacity of ten buckets, weighs a catty, and was made in September of 39." This bronze wok became an important basis for preliminarily judging the owner of the tomb and its age.

It took us more than two hours to make a tour of the underground palace. With the light of the flashlight, we found the original road along the west side of the stone wall of the cave, stepped on the tiles, climbed up the round hole collapsed in the south ear chamber and returned to the ground.

Du Rongquan and Zhang Zuliu agreed on the next work arrangement and returned to Shijiazhuang in the afternoon to report. Archaeologists also began the scientific cleaning, recording and mapping work with protection as the main task that afternoon.

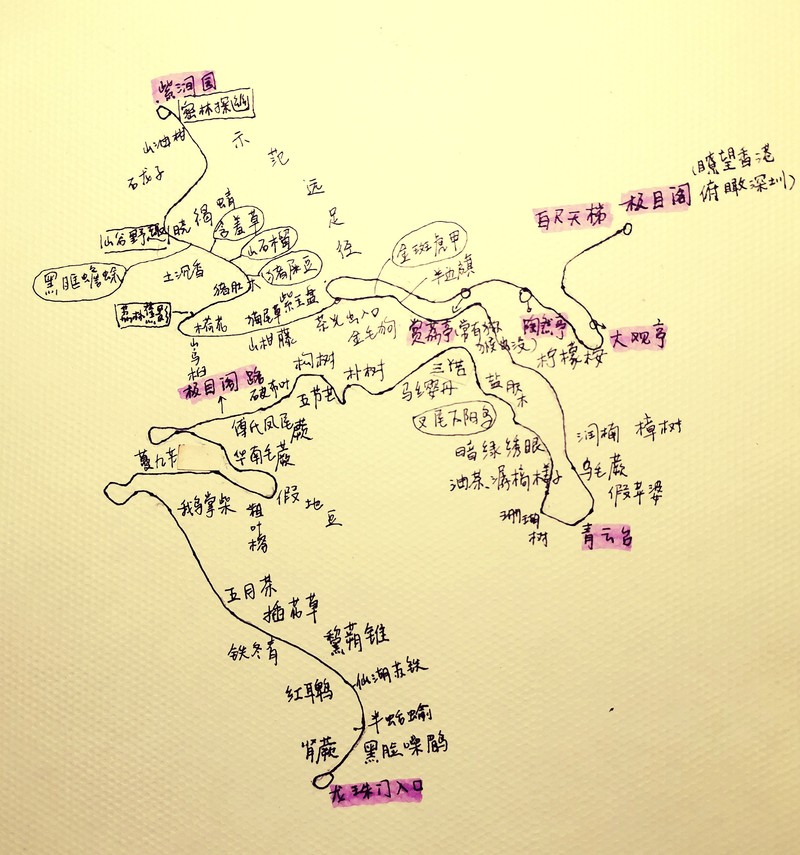

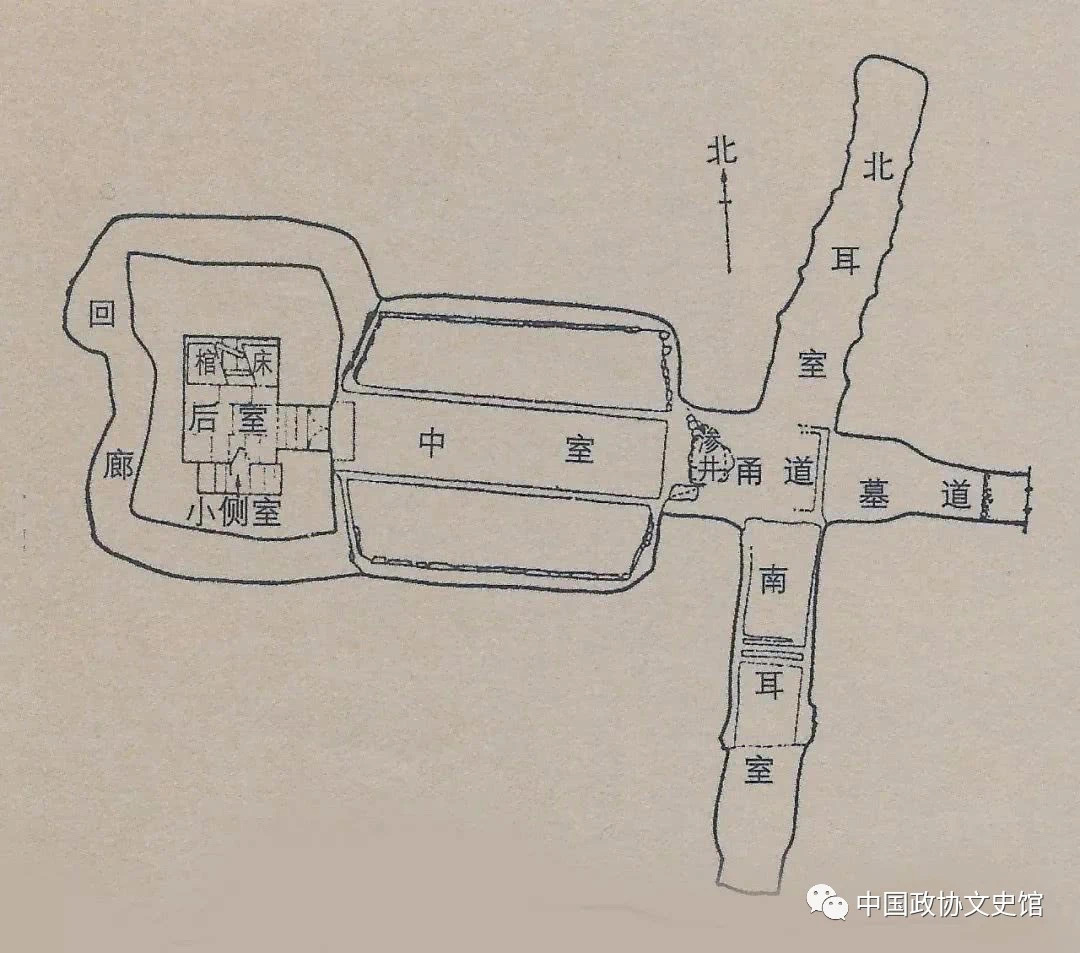

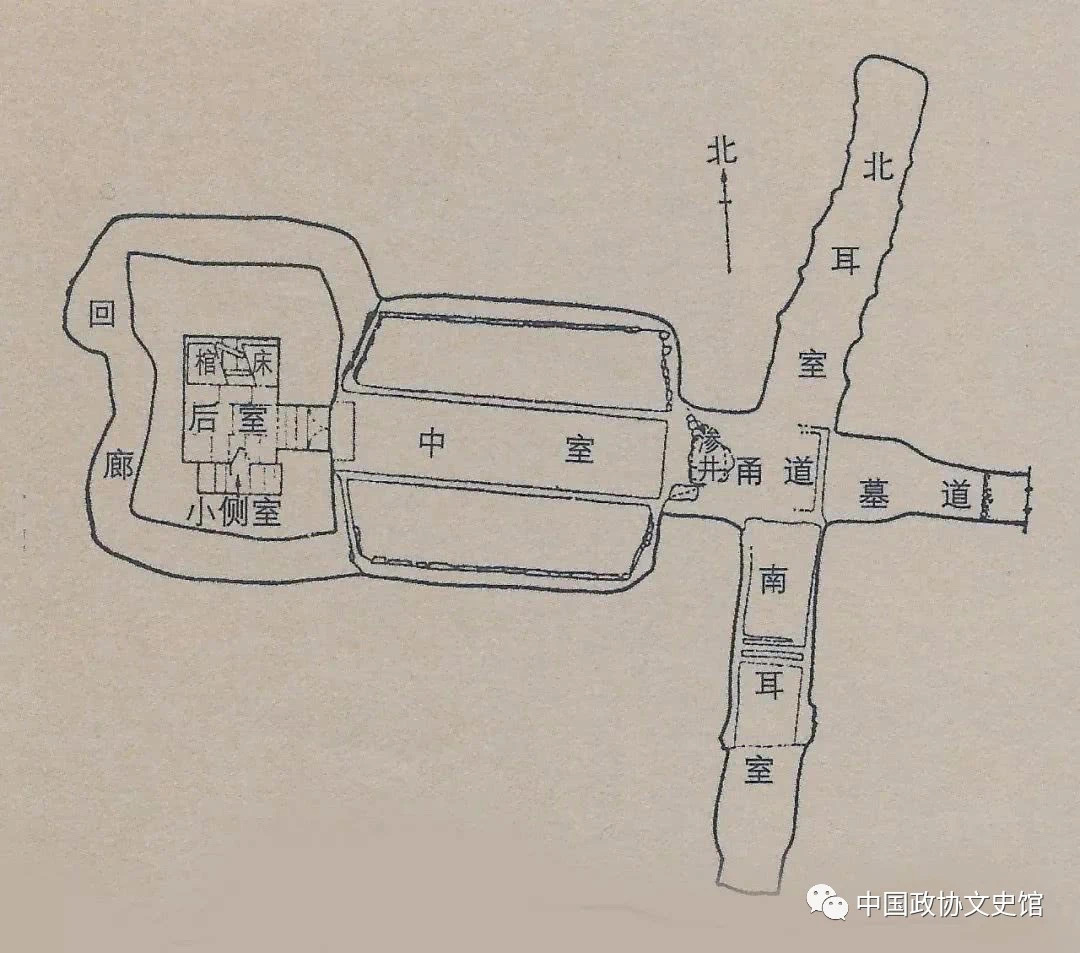

▲Schematic diagram of Liu Sheng tomb

This tomb includes the entrance of the tomb, the tunnel, the south ear room, the north ear room, the middle room, the main room and the cloister. According to the post-survey data, the total length of the cavern is 51.7 meters, the widest point is 37.5 meters, the highest point is 6.8 meters, and the volume of the cavern is 2700 cubic meters. The whole cave floor is paved with a layer of loess bed, and the side of the bed is paved with stone strips. The official entrance of the tomb is in the east, and it forms a central axis with the tunnel, middle room and main room in the west. The structure of the tomb spreads from north to south. Because the initial excavation was from the cave in the south ear room, the tomb door was cleaned up at the end. There is a pyramid-shaped mound in front of the tomb door, which is dug under the cliff face south of the main peak of Lingshan Mountain. The tomb is 1 north by east. The entrance of the pyramid-shaped mound is circular, and the two side walls are arc-shaped. From the vault to the ground, two layers of adobe are built, with a gap left in the middle, and then poured with molten iron to form a solid iron gate, which cannot be opened to form an iron wall; The iron gate is filled with large pebbles, stones and loess, which makes it impossible for future generations to dig and enter the tomb.

Investigators will write a special report on the results of preliminary investigation and cleaning, especially the bronze wares found in the tomb, and submit it to the provincial government. After that, it was transferred to the CPC Central Committee and Premier Zhou, and finally to Guo Moruo, president of China Academy of Sciences. According to Premier Zhou’s instructions, Guo Moruo sent Hu Shouyong from China Academy of Sciences, Wang Zhongshu from the Institute of Archaeology and Lu Zhaoyin and his party of 13 people to Mancheng and Hebei Provincial Cultural Relics Team to form an excavation team on June 26th to clean up the tomb.

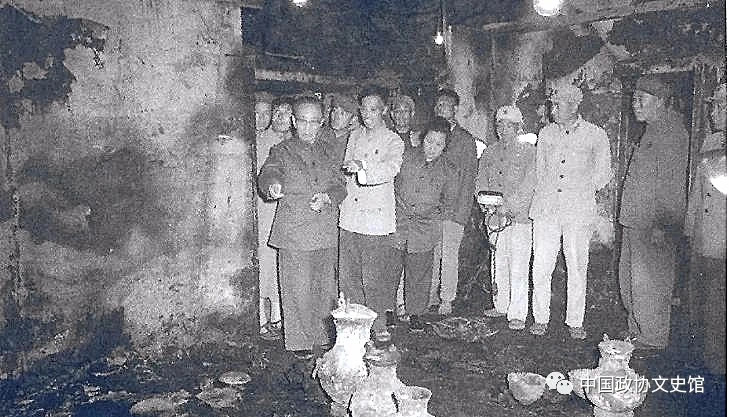

Guo Moruo visited the excavation site.

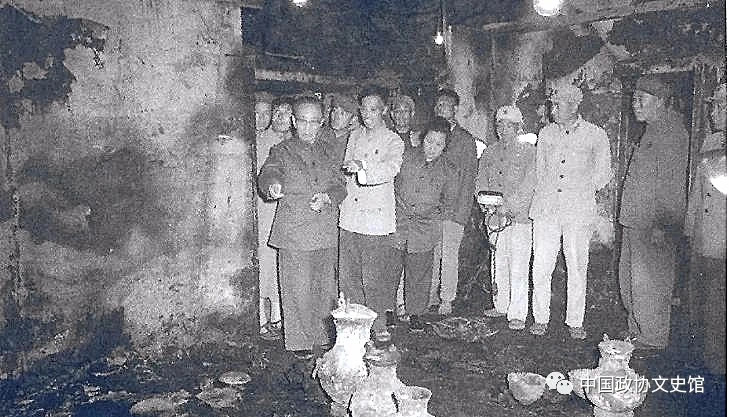

▲Guo Moruo (first from the left in the front row) is at the archaeological site of the Han Tomb in Mancheng.

During the excavation of Liu Sheng’s tomb, Guo Moruo received a report from Hebei provincial government to the State Council. According to a large number of bronzes with the inscription "Zhongshan Neifu" unearthed in the tomb and the contents of "34 years" and "39 years" in the inscription, he first pointed out that this is the tomb of Zhongshan State in the Western Han Dynasty, and that only Liu Sheng, the first generation of Zhongshan King, was the king of Zhongshan State for more than 39 years, and then determined that this tomb was the tomb of Liu Sheng, the king of Zhongshan Jing in the Western Han Dynasty. While making a scientific conclusion on such a crucial academic issue, Guo Lao also gave instructions on relevant details. Shortly after Liu Sheng’s tomb was opened, according to Premier Zhou’s instructions, he went to the city to inspect and guide himself, regardless of his age and long journey, especially the danger of the warfare during the "Cultural Revolution" at that time.

On July 21, the day before Guo Lao visited the city, the resident troops and archaeological teams received a notice: "Guo Lao is coming!" The excavation site and barracks apartment are boiling, and everyone is immersed in a very happy atmosphere like a holiday. According to the order given by Premier Zhou to the local garrison two days before Guo Lao came: "Guo Lao will visit the archaeological excavation site in the city, and the garrison will be responsible for the security work along the way." A sentry post was set 50 meters on both sides of the road along the way and escorted to the city.

At 6 o’clock on the morning of July 22nd, Guo Lao and his party set off from Beijing, made a short stop in Baoding at 9 o’clock, and then went all the way to the army barracks in Mancheng. After a short rest, they drove straight to Lingshan cemetery.

Guo Lao changed to a jeep at the foot of Nanling Mountain, and along the rugged mountain road, the car drove all the way to the level of Happy Valley Road in front of Liu Sheng’s tomb at the top of the mountain. Our archaeologists and the soldiers who participated in the excavation lined up in two rows to wait for Guo Lao. Guo Lao walked slowly out of the car accompanied by the head of the army, said hello to everyone, shook hands with the comrades one by one and asked everyone. Comrade Lu Zhaoyin, the head of the army, introduced Guo Lao.

Guo Lao first visited the geographical features of Lingshan, and then entered the tomb under the guidance of archaeologists. At that time, the main entrance of Liu Sheng’s tomb had not been dug, and it was necessary to enter and exit through the south ear chamber through the collapsed tunnel entrance. For the sake of safety, a wooden ladder was set at the entrance of the tunnel before Guo Lao arrived, so that the escalator could go up and down. With the help of the staff, Guo Laoshun entered the tomb by wooden ladder. From the carriage house into the aisle, through the food storage room, through the middle room, and then into the main room and cloister, Guo Lao watched us and explained. The temperature inside the cave is very low, and Guo Lao and our staff are all wearing cotton coats. Guo Lao read it very carefully, and put forward academic opinions every time he finished reading it, especially the bronze wares with inscriptions unearthed in the tomb, and put forward the interpretation methods and meanings one by one. When visiting the main room where Liu Sheng was buried, he was very careful. He pointed out: "Liu Sheng is a vassal, and the burial system is the most noble. Liu Sheng, dressed in gold and jade clothes, confirmed the authenticity of the gold and jade clothes recorded in Historical Records, the Book of the Later Han Dynasty and other records for the first time, which has very important scientific value. " Guo Lao gave detailed instructions on the recording, mapping and photography of the archaeological site, and also put forward suggestions on using infrared film to shoot the stone wall of the main room.

Guo Lao watched the North and South Lingshan Mountain, the main peak of Lingshan Mountain and the ancient road of Lingshan Mountain with great interest. While watching it, he also reminded everyone that "after the death of princes and nobles in the Han Dynasty, there was a system of repairing temples and trees", and quoted the examples of Taishique in Dengfeng, Henan Province and Gaoyique in Ya’ an, Sichuan Province. "There should be temples on this Lingshan Mountain. Have you found any remains?" Everyone replied that the architectural relics of the Western Han Dynasty have been discovered and are currently being studied. Guo Lao added: "There are a large number of artificial stone tablets in the north of the main peak and the junction with Liu Sheng’s tomb. If you want to check, there should be a queen’s tomb. Historical Records records that Liu Sheng had a son ‘ One hundred and twenty people ’ , "Hanshu" said he had ‘ One hundred people belong to Zizhi ’ , he ‘ Good wine and good meat ’ , and the ordinary brother of Emperor Wu, with extremely prominent position and great power, not to mention the rich Zhongshan, which is pyramid-shaped on the mountain ‘ Prince’s grave ’ It should be related to the historical records that he has many children. "It should be all his descendants."

After visiting for about two hours, Guo Lao went down the mountain by car and left for Beijing at 4: 30 pm.

Guo Lao’s inspection has brought great encouragement to the archaeologists. After more than 10 days of continuous work, people worked hard to clean up Liu Sheng’s tomb on August 2, and after detailed statistics, 5,509 cultural relics were unearthed.

Excavation of Queen Dou Wan’s Tomb

▲Changxin Palace Lantern Unearthed from Dou Wan’s Tomb

On July 22, 1968, after Guo Lao returned to Beijing, he reported to Premier Zhou the discovery of Han tombs in Mancheng, and Premier Zhou gave instructions. Soon, the Hebei provincial government and the garrison troops received a notice from the State Council, demanding that the cave remains of Tomb No.1 be preserved in situ and the cultural relics be transported to Beijing for study, and decided that the original team would continue to excavate another tomb north of Liu Sheng’s tomb, namely Dou Wan’s tomb. On August 6th, the provincial government sent Comrade Zhang Tianfu to Beijing to study the next work, and at the same time sent a small number of people to conduct on-the-spot investigation to determine the specific location of Tomb 2. After 10 days’ rest, the excavation personnel gathered in the city on August 12. The China Academy of Sciences and the Hebei Provincial Government attached great importance to it and sent leading comrades to come. After conveying the relevant instructions of the central authorities, the excavation work was officially launched on August 13th.

First, it starts from the north third of Tomb No.1.. There are no layered natural rocks on the slope, only rocks turned from the middle. Below the rubble is loess, and below it are the large and small stones that fill the tomb. After the layers were cleared, the top of the pyramid-shaped mound was exposed on the afternoon of August 14th. Judging from the accumulation of stones, the volume of the tomb is not too small. The arch coupons dug manually along the tomb door are cleaned downwards, and the brick and iron walls that seal the door are opened to enter the tomb. The structure in the tomb is basically the same as that in the No.1 tomb, including the tomb entrance, the tunnel, the south and north ear rooms, the middle room and the main room. Liu Sheng’s pyramid-shaped mound gate and Dou Wan’s pyramid-shaped mound gate are almost on the same level.

The excavation of Dou Wan’s tomb began at 8: 30am on August 13th, 1968 and ended on September 19th, with 5,124 cultural relics unearthed.

From the discovery of Tomb No.1 on May 23rd to the end of the excavation of Tomb No.2 on September 19th, the excavation of Liu Sheng and Douwan tombs lasted for 111 days. During the period from August 3rd to 12th, there were 10 days of rest and 101 days of actual field work.

Uncover the mystery of golden thread and jade clothes

▲Unearthed site of Liu Sheng’s tomb.

The cultural relics buried in the Han tombs in Mancheng are extremely rich, with more than 10,000 precious cultural relics unearthed from the tombs of Zhongshan Wang Liusheng and his queen Dou Wan.

Liu Sheng and Dou Wan were both dressed in gold and jade clothes after their death. Liu Sheng was a man and Dou Wan was a woman. It’s all gold thread. Here we mainly introduce Liu Sheng’s gold thread and jade clothes.

The main room is the most abundant burial place in Liu Sheng’s tomb, and a large number of precious cultural relics are found in the main room. Liu Sheng is wearing a golden jade garment which was discovered for the first time in China. It comes out of the coffin of the main room. As far as the whole tomb is concerned, the main room is in the center of the whole tomb and belongs to the hidden coffin.

On July 12th, the stone gate of the main room was opened. When archaeologists first saw such a strange burial suit woven with gold wire and shiny jade pieces, everyone gave a sigh unconsciously. Wow! I almost jumped for joy. For a group of archaeologists, some of us have been engaged in archaeological work for decades and have never seen such luxurious burial clothes. Everyone only knows from Records of the Historian, Hanshu and other relevant records that the emperors and princes of the Han Dynasty wore gold and silver jade boxes or jade boxes for burial after their deaths, but never saw the real thing. According to the cultural relics reports, before liberation, archaeologists unearthed jade pieces in the Western Han Tomb in Wang Lang Village, Handan. At that time, it was called "Zhu Li Shi" in "Mozi Festival Funeral". Everyone said in unison, "This important discovery is bound to cause shock at home and abroad."

As a personal form, jade clothes are complete, including head, trunk, limbs, hands and feet, etc. The deceased was lying on his back in jade clothes, and his head was covered with a rectangular gold-plated jade-inlaid copper pillow. Put your hands on your lower abdomen, hold Yuhuan in your left hand and Yugui in your right hand. Cover the genitals with a round jade jar. There is a jade plug in the anus. There is a long-handled iron ring knife on the left side of the jade garment, and there is a gold belt on the side of the knife. There are two handles of jade tools and iron swords on the right side of the jade clothes. A large number of jade articles and weapons were buried between the coffins on the right side of the jade clothes. These are all things that the deceased carried with him before his death.

Liu Sheng’s jade clothes, when cleaning the back room, were covered with a layer of rotten wood and patent leather due to the collapse of the slate at the top of the room and the collapse of the coffin. After gently removing the paint skin and rotten wood board ash with a bamboo stick and a brush, I found this golden jade garment made up of gold wire and jade pieces. The corpse of the owner of the tomb has been decayed for a long time, which has turned the jade garment into a 1.88-meter-long flat body composed of jade pieces. The head, coat, trousers, gloves and shoes have been deformed. Some gold wires with jade pieces have also been broken. Clean up and reinforce at the same time. Clean up the numbering, drawing, photographing and recording one by one at that time. If it has been found that the position is wrong, it should be restored to its original position, and the gold wire and jade piece should be reinforced one by one. So that all the parts of it are no longer loose and disorderly. Draw a large map on the spot. Mark the numbers on the drawing one by one, and take photos and records with the cleaning. But it is more detailed about the front. However, the back of the jade garment is still under pressure and technical work cannot be carried out. So do it indoors after taking it off.

▲The staff is at the archaeological site of the Han Tomb in Mancheng

The method of taking it is to adopt the method of self-made metal wire mesh and dish out. According to the size of the jade garment, a rectangular frame is made of iron wire with a thickness of 6 mm, which is set around the jade garment. Use thin wire to pass back and forth from under the jade clothes in vertical and horizontal straight lines, and tighten and straighten the thin wire, so as not to be careless. Then, the two ends of the fine iron wire are twisted on the outer frame of the thick iron wire, so that the fine iron wire forms a square mesh under the jade clothes, and the jade clothes can be lifted more smoothly. In order to prevent the surface of the jade garment from being disordered during extraction, several layers of hemp paper were laid on the jade garment, and a layer of 2-mdash was poured on the hemp paper. 3 cm of plaster. After such treatment, the jade clothes become a whole, and the jade clothes can be extracted smoothly and steadily, put on the prepared mat, and spread two layers of hemp paper on the cotton with a thickness of about 5 cm, and put in a rectangular wooden box. Cover it with two layers of hemp paper, and then spread it with cotton and transport it indoors. When finishing, gently remove the hemp paper, cotton, gypsum and hemp paper in turn. Disassemble the screen, and repair the jade clothes according to the original big picture measured.

▲Golden wisp jade clothes unearthed from Dou Wan’s tomb (after restoration)

▲Golden wisp jade clothes unearthed from Liu Sheng’s tomb (after restoration)

The shape of jade clothes is the same as that of human body, which is basically designed according to various parts of human body. Jade pieces with different shapes are used, including square, rectangle, quadrangle, polygon, trapezoid, triangle, ring wall and so on. Face, head and hand jade pieces are 1.5— 3 cm, width 1— 2 centimeters. Jackets, trousers and shoes are large, generally 4.5 cm long, 3.5 cm wide and 0.2&mdash thick; 0.35 cm.

After each piece of Pian Yu is polished, the edges and corners are ground with hypotenuse, and holes are punched out at the four corners or around each piece, which are braided with gold wire. Jade garment is composed of 2498 Pian Yu pieces, and the weight of shared gold thread is about 1100g.

Jade clothing is also called jade box or jade bang. According to the Records of Etiquette in the History of the Later Han Dynasty, the emperor’s jade clothes were made of gold thread, the princes and princes began to seal them, the nobles and princesses used silver thread, and the dignitaries and princess royal used copper thread. Jade clothes have been customized in the later Han Dynasty. According to the records, Liu Sheng can only use silver and jade clothes, but what actually appears is gold and jade clothes. There are only "jade clothes" and "jade sticks" in the records of Hanshu, but there is no distinction between gold, silver and copper strands. This is because it was not customized at that time.

When it was discovered, the golden thread jade garment was flattened because of the collapse of the roof. There were no formed bones, and some comrades doubted whether there were any bones at that time. That is, whether there is a body in the original jade clothes. This problem has not been solved in the excavation site. After entering the room, it was discovered that the bones in the jade clothes had already turned into grayish brown powder due to the dissolution of groundwater and limestone, and the enamel shells of some teeth were also found inside the head. To be sure, the bones have decayed in the jade clothes, leaving only traces.

This article is selected from the 163rd Collection of Literature and History Materials sponsored by Chinese People’s Political Consultative Conference Culture, Literature, History and Learning Committee and compiled by the Literature and History Museum of the Chinese People’s Political Consultative Conference. The article title, some subheadings and pictures are added by the editor. Zheng Shaozong, once the archaeological leader of Jehol Provincial Museum and the director of Hebei Provincial Institute of Cultural Relics.